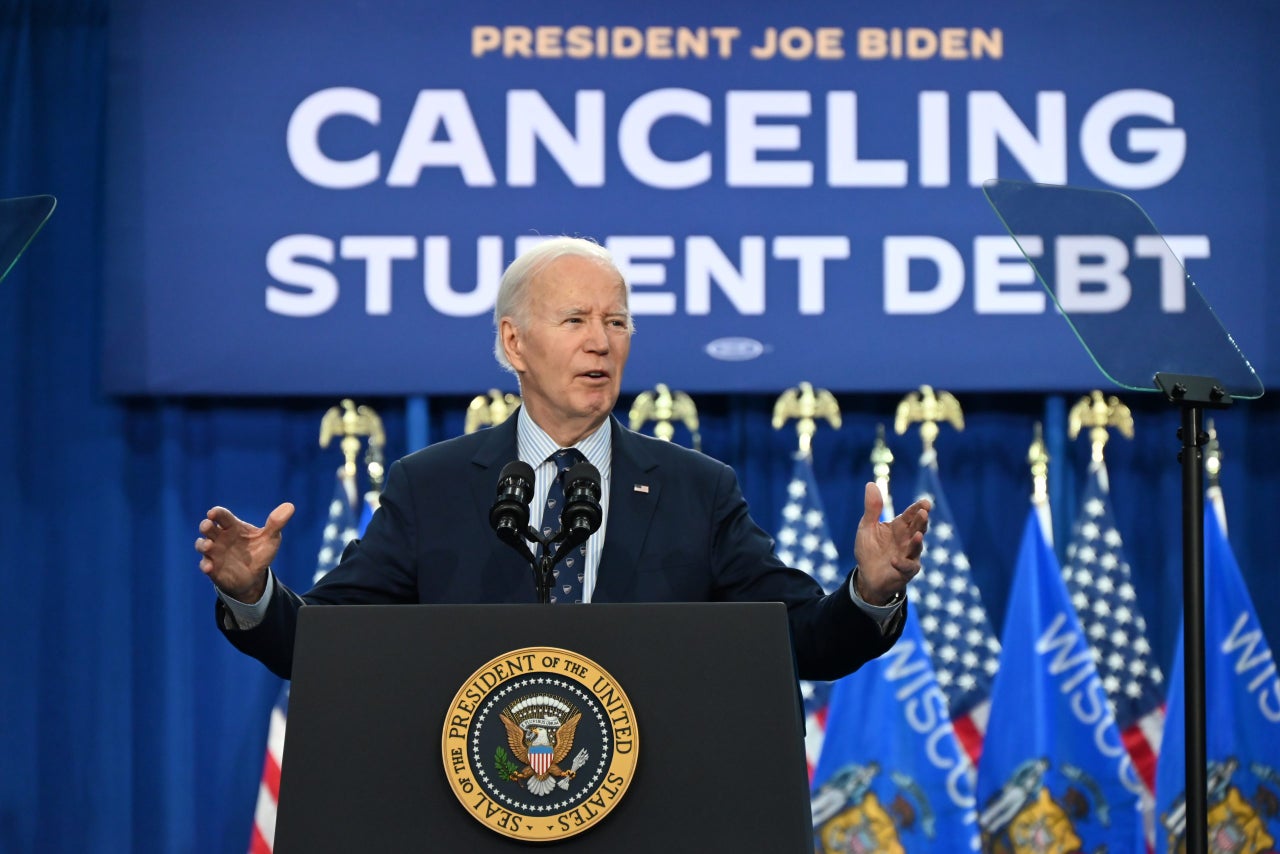

The Biden administration has announced a significant student loan forgiveness plan aimed at providing relief to more than 30 million borrowers. This plan comes as President Biden’s efforts to cancel student debt have faced obstacles, including a blockage by the Supreme Court last year.

By using its existing authority and circumventing Congressional or court approval, the administration has provided relief to millions of borrowers since then.

During a visit to Madison, Wisconsin on Monday Biden said, “This relief can be life-changing,” Biden said. “Folks, I will never stop to deliver student debt relief on hardworking Americans, and it’s only in the interest of America that we do it. And again, it’s for the good of our economy that’s growing stronger and stronger — and it is. By freeing millions of Americans from this crushing debt … it means they can finally get on with their lives, instead of their lives being put on hold.”

Here are the key points of the latest proposed plan:

1.Cancellation of Accrued Interest: The plan entails canceling up to $20,000 of accrued interest for borrowers, regardless of their income level. This measure is intended to alleviate the burden of interest payments for millions of borrowers.

2.Income-Driven Repayment Plan: Low- and middle-income borrowers enrolled in an income-driven repayment plan would have all of their accrued interest forgiven. This provision aims to target relief for individuals facing financial hardship.

3. Automatic Relief: Borrowers do not need to submit an application to receive the relief. The plan is designed to streamline the process and ensure that eligible borrowers automatically benefit from the forgiveness program.

4.Estimated Impact: If implemented as proposed, the plan is expected to entirely eliminate accrued interest on the unpaid balances of 23 million borrowers. Additionally, it would completely wipe out the debt of 4 million Americans while providing partial relief of at least $5,000 to over 10 million additional borrowers.

5. Eligibility Criteria: The Education Department has identified four categories of borrowers who are automatically eligible for relief. These include individuals whose loan balances have grown significantly beyond the original amount borrowed, borrowers in repayment for over 20 years, those eligible for relief but have not applied, and individuals whose educational institutions failed to provide adequate financial value.